Product depreciation calculator

This Calculator estimates your. Depreciation Amount Asset Value x Annual Percentage Balance.

Calculating Depreciation Unit Of Production Method

Depreciation Calculator user reviews from verified software and service customers.

. The calculator allows you to use. Our Product Eazy Asset. The depreciation rate 15 02 20.

The formula of the depreciation and appreciation is the same rates are either below zero depreciation or above. Based on Excel formulas for SYD. Depreciation amount 5000 x 20 1000 Decreasing Balances Method The netbook value per year is taken as a basis not the purchase.

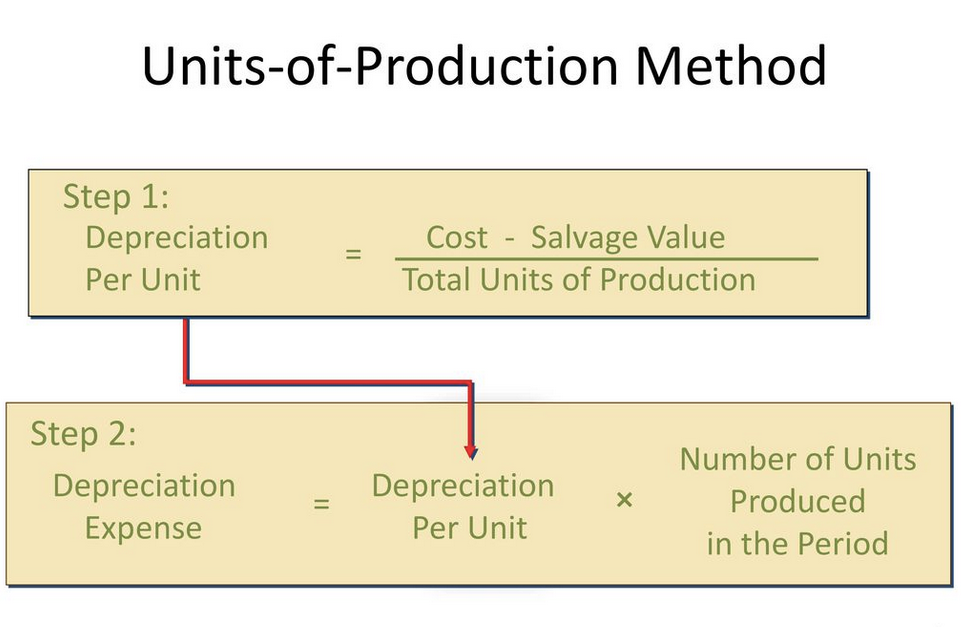

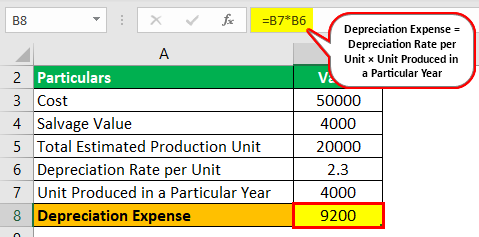

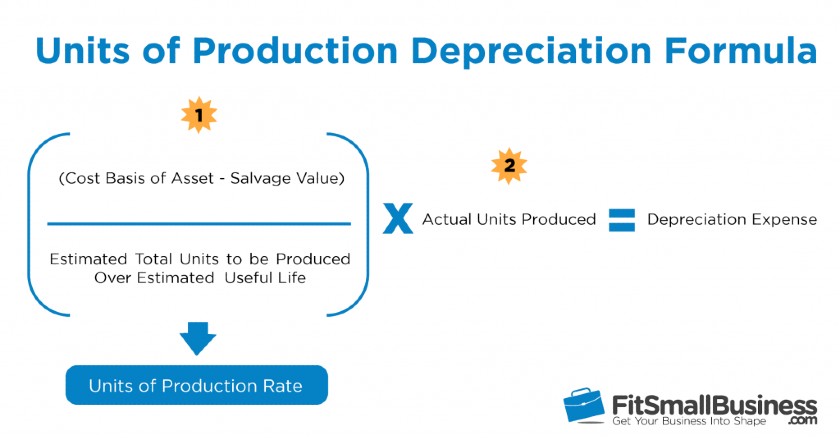

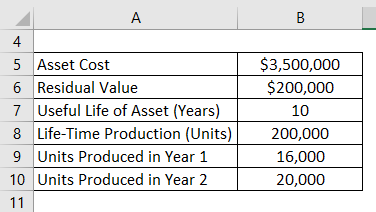

Explore ratings reviews pricing features and integrations offered by the Fixed Asset Management. The units of production depreciation calculator designed by iCalculator does the complex calculations for you with just a fraction of the effort that it takes for performing calculations. The Formula for calculating depreciation using the unit of production method is as follows.

1 nth root of Residual ValueCost of the asset 100 where n useful life Related Topics Depreciation. This depreciation calculator is for calculating the depreciation schedule of an asset. Instant download Professional design easy to use Fully editable Compatible with Excel 2010 and later Support available Ready to use.

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Unit of Production Depreciation Depreciable Value Actual Number of Units. Depreciation Calculator The calculator should be used as a general guide only.

The following formula determines the rate of depreciation under this method. Depreciation Calculator has been fully updated to comply with the changes made by the Tax Cuts and Jobs Act TCJA legislation that affect the calculation of fixed asset depreciation Section. Depreciation means the products future value is less than the original value.

Compare the best Depreciation Calculator alternatives in 2022. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. This is an easy to use depreciation calculator template that can give you the annual depreciation rates and book values using straight-line double.

Non-ACRS Rules Introduces Basic Concepts of Depreciation. It provides a couple different methods of depreciation. Explore user reviews ratings and pricing of alternatives and competitors to Depreciation Calculator.

Sum-of-Years Digits Depreciation Calculator Calculate depreciation for any chosen period and create a sum of years digits method depreciation schedule. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. There are many variables which can affect an items life expectancy that should be taken into consideration.

First one can choose the straight line method of. This Calculator tells you how many days you need to rent your car to Generate Purchase Price or to cover your monthly loan payment and insurance payment.

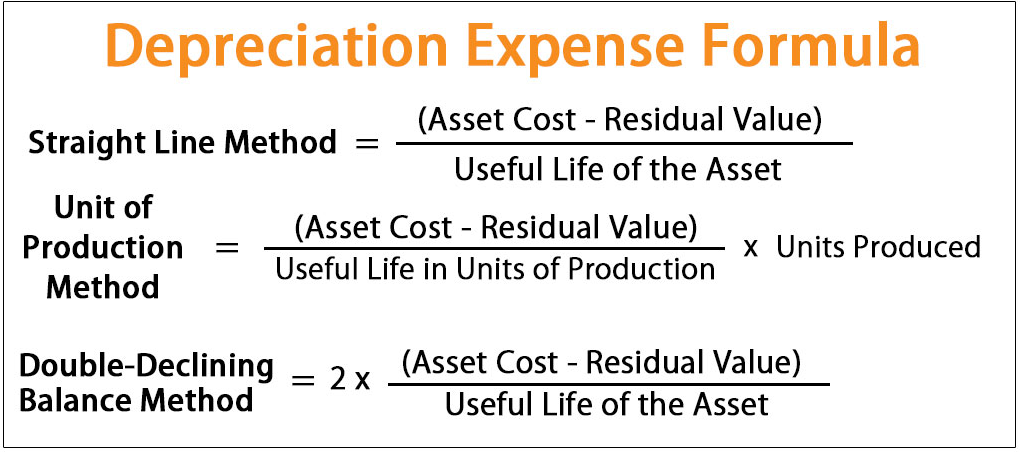

Depreciation Formula Calculate Depreciation Expense

How Do I Calculate Depreciation Formula Guides Examaples

Depreciation Formula Examples With Excel Template

Unit Of Production Depreciation Method Formula Examples

Depreciation Expense Calculator Factory Sale 50 Off Www Ingeniovirtual Com

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Unit Of Production Depreciation Method Formula Examples

Depreciation Formula Examples With Excel Template

Depreciation Expense Calculator Hot Sale 57 Off Www Ingeniovirtual Com

Units Of Production Depreciation Calculator Double Entry Bookkeeping

Depreciation Expense Calculator Factory Sale 50 Off Www Ingeniovirtual Com

Depreciation Formula Calculate Depreciation Expense