Employer payroll cost calculator

On top of that the employer will. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

All inclusive payroll processing services for small businesses.

. 2020 Federal income tax withholding calculation. Prepare your FICA taxes Medicare and Social Security monthly or. Ad Compare This Years Top 5 Free Payroll Software.

Payroll Cost Calculator Cyprus Tax. How to File Your Payroll Taxes. Free Unbiased Reviews Top Picks.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Plans Pricing How it Works. Employees cost a lot more than their salary.

Our online service is available anywhere anytime and includes unlimited customer support. 2995 allows you to add bonuses and taxable benefits in addition to wages. Taxes Paid Filed - 100 Guarantee.

True Cost of an Employee calculator user guide. Payroll for all worker types. When you choose SurePayroll to handle your small business payroll.

Compliance and AI. We calculate file and pay all federal state and local payroll taxes on your behalf. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2.

Lets say that same employee worked 45 hours the following week. Ad Accurate Payroll With Personalized Customer Service. Ad Calculate Your Payroll With ADP Payroll.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Get Started With ADP Payroll. Ad GetApp helps more than 18 million businesses find the best software for their needs.

Process Payroll Faster Easier With ADP Payroll. Calculate your startup costs. Once the total overhead is added together divide it by the number of employees and add that figure to the employees annual labor cost.

When you think about adding a new employee to your payroll determine what the actual financial cost of doing so means to your business. The true salary cost in France is the total amount of the basic pay bonuses and employer payroll costs that the company pays out each year for wages in France. Our Expertise Helps You Make a Difference.

Process Payroll Faster Easier With ADP Payroll. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Stop paying fees each time you process.

40 hours worked x. If payroll is too time consuming for you to handle were here to help you out. Get Started With ADP Payroll.

The Employment Allowance is designed to stimulate recruitment by allowing qualifying employers to save up to. Ad Calculate Your Payroll With ADP Payroll. If you want a.

Ad The Best HR Payroll Partner For Medium and Small Businesses. Get a free quote today. For example if John has a basic salary of 10000 per year and receives an annual bonus of 1000 then his employer has paid him a total of 11000.

Get 3 Months Free Payroll. Take a Guided Tour. The Calculator will show the total payroll cost at the end.

40 hours worked x 14 per hour 560. Benefits are taxed at the same 1505 rate as ordinary earnings in 202223. In this case the employees annual labor cost is.

In that instance you would calculate gross pay like this. Jo Landers does not guarantee the. Check all data is complete via accuracy engine.

Medicare 145 of an employees annual salary 1. Could be decreased due to state unemployment. Our employee cost calculator shows you how much they cost after taxes benefits other factors are added up.

Get a free quote today. Get 3 Months Free Payroll. Our payroll cost calculator quickly calculates your total payroll costs including the social insurances and GHS GESY contribution per year.

Paycors Tech Saves Time. Subtract 12900 for Married otherwise. Heres a step-by-step guide to walk you through.

Ad Payroll So Easy You Can Set It Up Run It Yourself. See the Payroll Software your competitors are already using - Start Now. We also provide Cost of.

The Excel Version of the Employee Cost Calculator cost. Steps 1 to 3 allow you to enter the direct remuneration costs of an employee. We hope these calculators are useful to you.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. The standard FUTA tax rate is 6 so your.

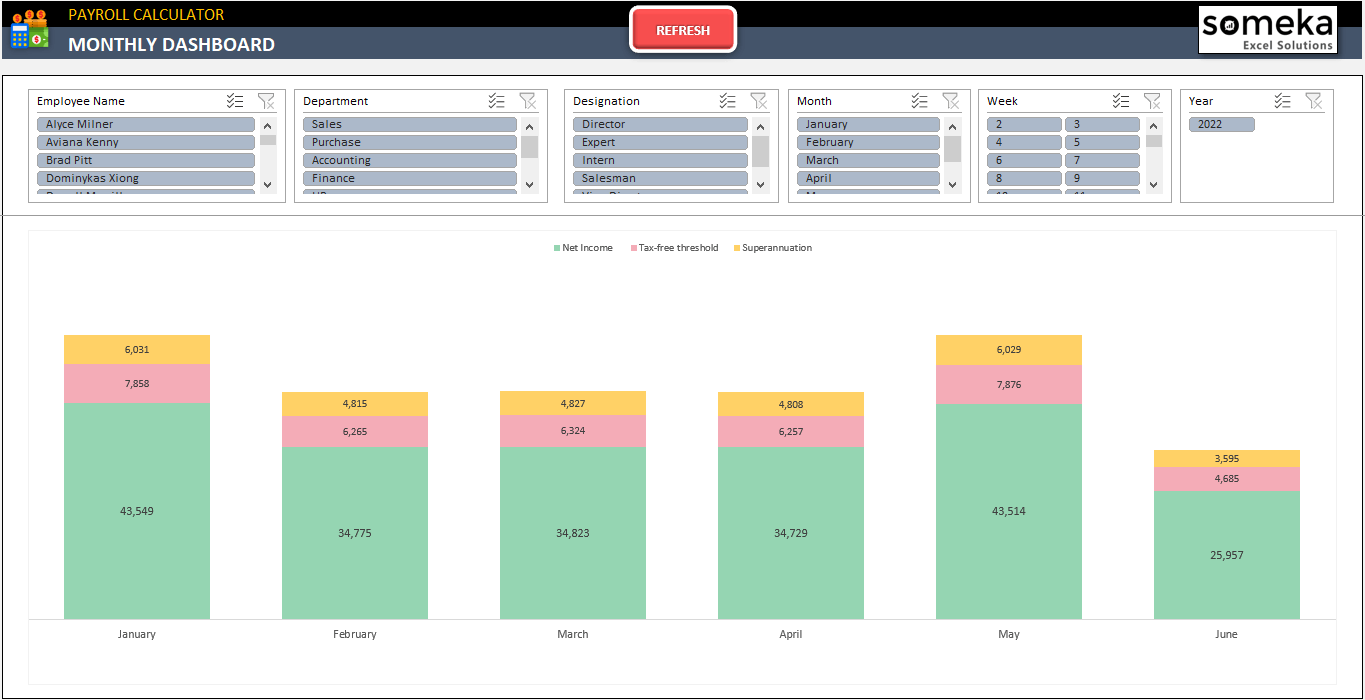

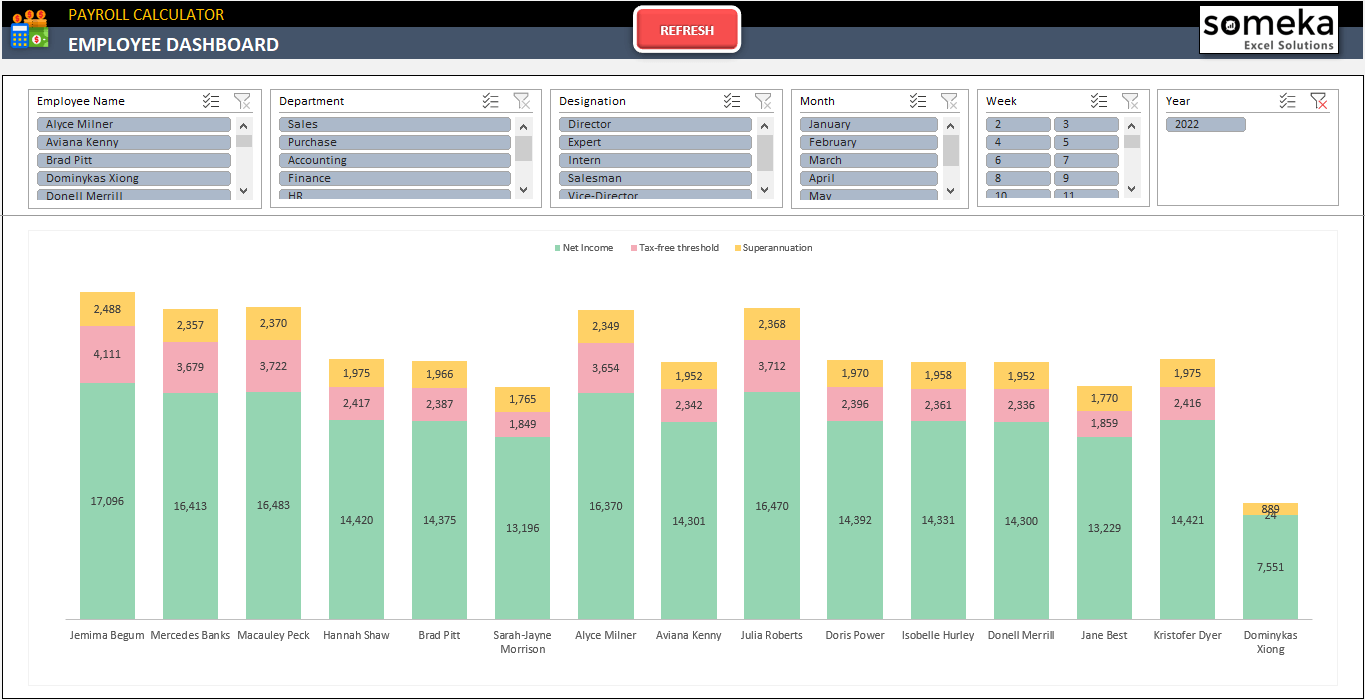

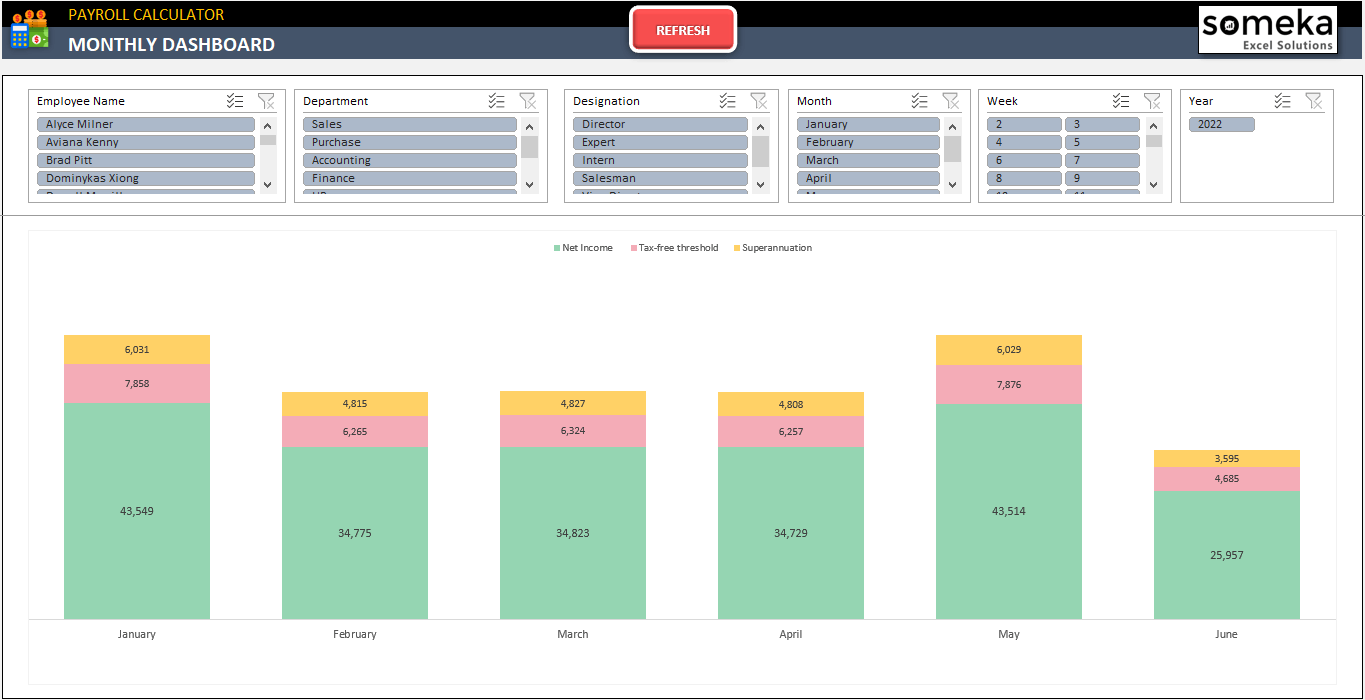

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Payroll Calculator Calculate Costs Of Hiring Staff In Latin America

Download Employee Turnover Cost Calculator Excel Template Exceldatapro Employee Turnover Employee Recruitment Employee Onboarding

Payroll Paycheck Calculator Wave

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Tax Calculator For Employers Gusto

Payroll Calculator Free Employee Payroll Template For Excel

Download Total Compensation Spend Rate Calculator Excel Template Exceldatapro Payroll Template Compensation Calculator

Pin Page

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Attendance Sheet Template

Employee Cost Calculator Updated 2022 Employee Cost Calculation

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Salary Calculation Sheet Template As The Name Indicates Is A Spreadsheet That Helps Calculate Each Employee Payroll Template Spreadsheet Design Excel Formula

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Free Employer Payroll Calculator And 2022 Tax Rates Onpay